This is one that I’ve been asked a bunch of times! It’s a good question and one that bears repeated asking.

Short answer: property and mortgage values and cash flow.

Longer answer: it’s a function of the dymanics of the city. As a landlord myself, here’s the analysis/format I use in looking at this. If you want to buy a $150,000 home, as an investment, you need at least 20% down. Let’s assume $1000 a year in insurance and another in taxes.

For investment purposes then, this home is going to cost a $30,000 down payment and at a 4.5% APR, cost a landlord $777 a month to pay principal, interest, taxes and insurance.

A landlord is going to need cash flow, too, to be prepared for emergencies and have a return on their investment. In this case, that $150,000 3 Bed, 2 bath home may rent for $1000-1150. The landlord is “cash flowing” about $223-373 in this case. However, that does not account for their costs any time anything breaks. This isn’t profit for the landlord, necessarily, as there are taxes and maintenance of the home involved, too.

It scales from there…a $175K home requires a 35K down payment (as an investment property) and costs $878 a month to carry in this scenario.

LARGE CAVEAT: This is for a 20% conventional loan, investment property. An owner occupied home will require much less down but have a higher overall mortgage as a result.

Looking to buy or sell a home in Colorado Springs? Please call Rob at 719-440-6626 or email me at robthompsonrealtor@gmail.com.

*This is not legal or financial advise just sharing information and experience. Always consult a CPA, lender or attorney as needed.

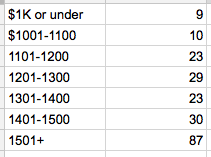

Looking to rent a home in Colorado Springs? Interestingly, there are 124 MLS listed Single Family Homes (SFH) w/3+ bedrooms on the market at $1500 and below. There are 87 on the market at $1501 and above.

Looking to rent a home in Colorado Springs? Interestingly, there are 124 MLS listed Single Family Homes (SFH) w/3+ bedrooms on the market at $1500 and below. There are 87 on the market at $1501 and above.